michigan gas tax increase

However a push for raising the gas tax auto registration or both is seen by many as all but. Michigans Democratic Gov.

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Inflation factor value of increase.

. On January 1 2022 Michigan drivers started paying a tax of a little more than 27 cents per gallon for the state motor tax aka gas tax. Diesel Fuel 272 per. The further automatic increases were scheduled to occur each year starting in 2022.

Michigan Senate passes increase in gas tax. Phased in over three years the plan would raise both the gasoline and diesel tax to 34 cents per. 1927 2 to 3 001 05 1466 015 1951 45 to 6 002 0333 101 015 1972 7 to 9 002 0286 624 012 1979 9 to 11 002 0222 376 008 1984 1261 to 1455 002 0154 252 005 1997 1455 to 18715 004 0286 161 007 2017 18715 to 259055 007 0384 106 008 august 2019 inflated cpi.

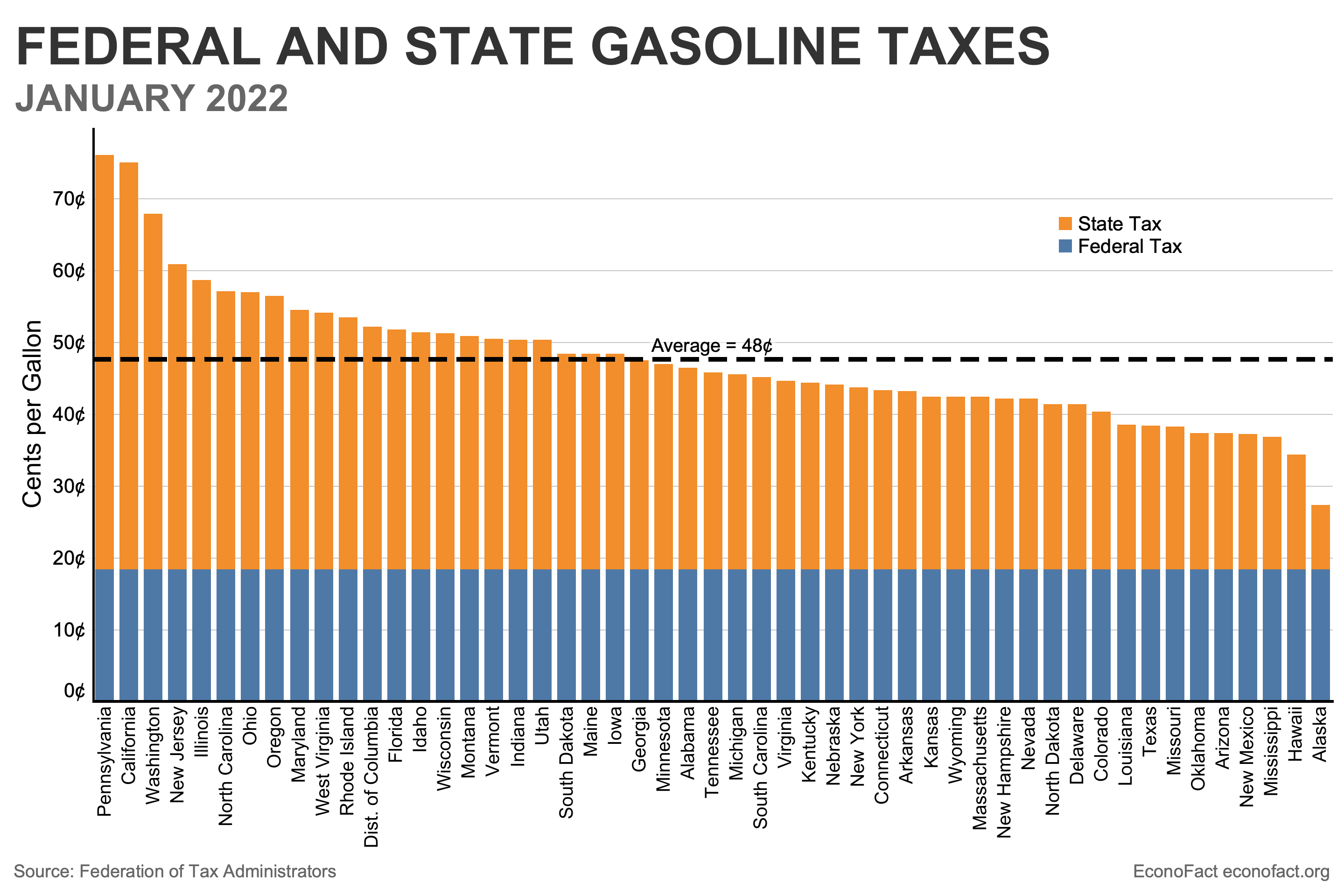

Pennsylvania is now the highest at 576 cents per gallon. The increase is capped at 5 even if actual inflation is higher. It will have a 53 increase due.

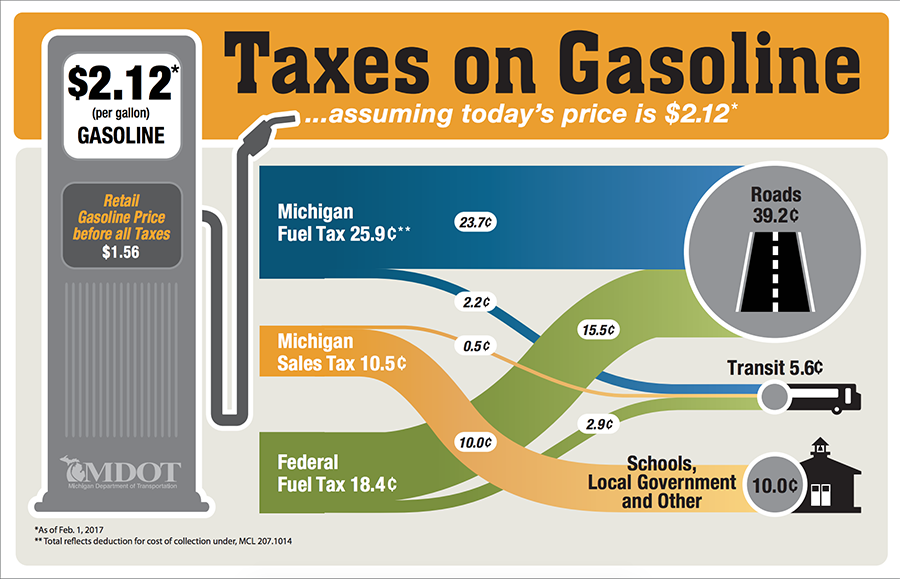

As of January of this year the average price of a gallon of gasoline in Michigan was 237. Mar 25 2020 The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St. Whitmer is bonding for over 35 billion to finance fixing trunkline roads which have been destroyed by.

Brian Calley but the Senate passed a 15. Heres a quick way to see how much more per week and year youd. The 2015 Michigan law also included a 20 increase in vehicle registration fees beginning in 2017.

Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel. The current gas and diesel tax rates are 19 cents and 15 cents per gallon respectively. Currently Michigans fuel excise tax is 263 cents per gallon cpg.

Alternative Fuel which includes LPG 263 per gallon. Whitmer failed in her push for a 45-cent-per-gallon gas tax increase which the governor claimed would raise an estimated 25 billion. Rack Payment of Michigan Fuel Excise Taxes Payments of fuel excise taxes are made by fuel vendors not by end consumers though the taxes will be passed on in the fuels retail price.

The 45-cent increase would bring Michigans gas tax to 713 cents a gallon the highest in the nation. To increase the state gasoline and diesel taxes to 223 cents per gallon starting Oct. Also it would more than double the current 15-cent tax on diesel.

The goal Whitmer said is to generate about 2. For fuel purchased January 1 2022 and after. Gas and Diesel Tax rates are rate local sales tax varies by county and city charged in PPG Other Taxes include a 075 cpg UST gasoline and diesel Hawaii.

The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. Under the plan Michigans current 19-cent per gallon tax on gasoline would increase to 24 cents in October 2015 29 cents in January 2016 and a final 34 cents in January 2017. Gretchen Whitmer wants to nearly triple the states gas tax to raise about 2 billion per year for roads.

By Jack Spencer February 2 2013. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. Gasoline 272 per gallon.

Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation. Under the legislation the gas tax and the diesel tax both increased to 263 cents per gallon in 2017 from 19 cents a gallon and 15 cents a gallon respectively. In Michigan Jet Fuel is subject to a state excise tax of 003 Point of Taxation.

That includes a roughly 1-cent automatic increase to the state gas tax on. Diesel Fuel 263 per gallon. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

The excise tax would reach 413 cpg in October 2019 563 cpg in April 2020 and 713 cpg in October 2020. The bill would increase the diesel tax to 19 cents on Oct. The current state gas tax is 263 cents per gallon.

LANSING It took a tie-breaking vote by Lt. Gasoline 263 per gallon. 1 2018 and after that index the amount to inflation.

Is A Michigan Gas Tax Increase Inevitable. Under the governors proposal a 45-cent increase would occur in three 15-cent increments over a one-year period. Whitmers proposed three-step increase over a one-year period would give Michigan the highest fuel taxes in.

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. For fuel purchased January 1 2017 and through December 31 2021. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk of lawmakers looking to existing resources to achieve the 14 billion price tag.

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Michigan Gas Prices Would Drop 50 Cents Under Senate Approved Summer Tax Cut Mlive Com

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

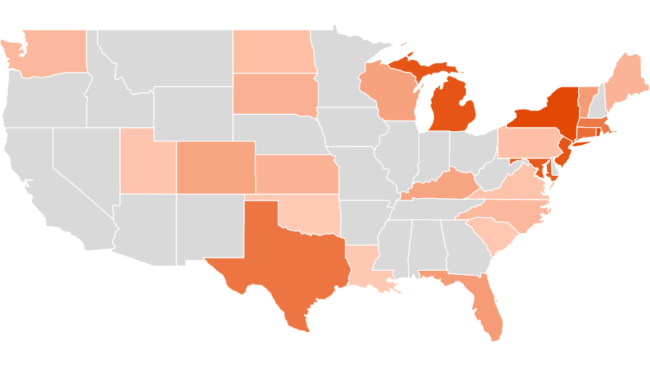

Highest Gas Tax In The U S By State 2022 Statista

State Corporate Income Tax Rates And Brackets Tax Foundation

Michigan Gas Tax Going Up January 1 2022

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Resident Information Ottawa County Road Commission Michigan

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

Michigan S May Tax Proposal Mackinac Center

Whitmer Takes Flak For Calling 20 Cent Gas Tax Hike Ridiculous

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Michigan Has Low Gas Tax Except When It Doesn T Michigan Capitol Confidential

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com